The Current US Economic Issues and Their Effect on the Stock Market

June 17, 2022

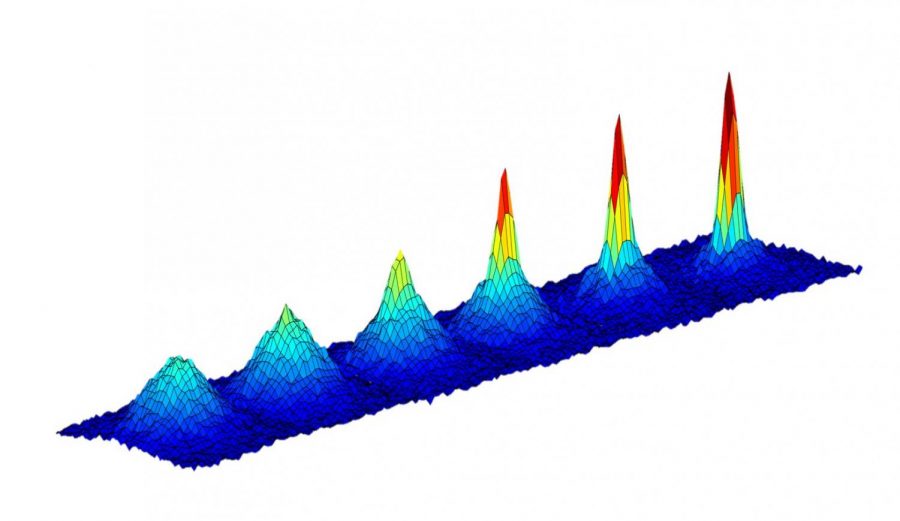

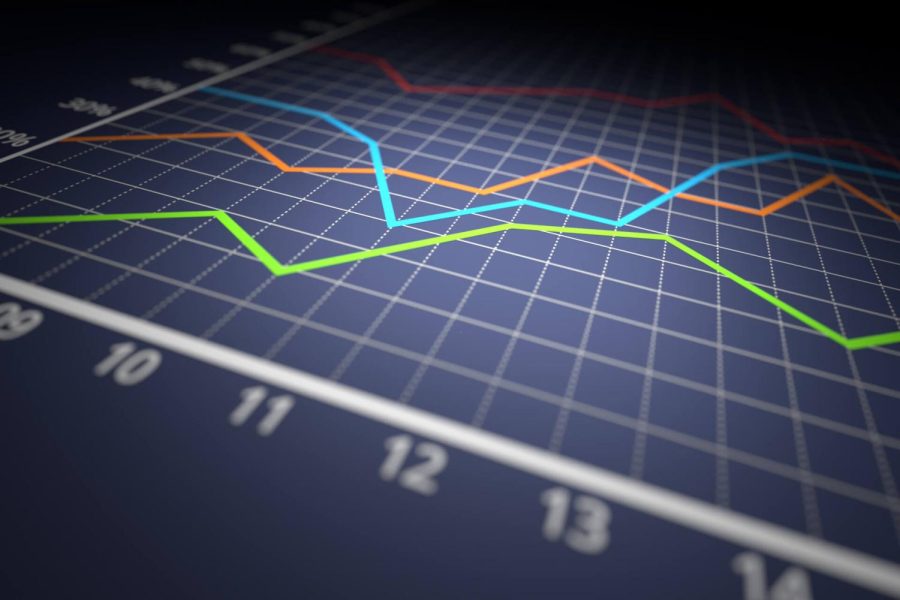

Recently, the massive fall in the stock market has caused many investors to become quite apprehensive. This crash has been caused by one prominent factor – inflation. On Friday, it was announced that consumer prices have climbed 8.6% throughout 2022. This number is higher than last year’s rise in prices and is the greatest increase since 1981.

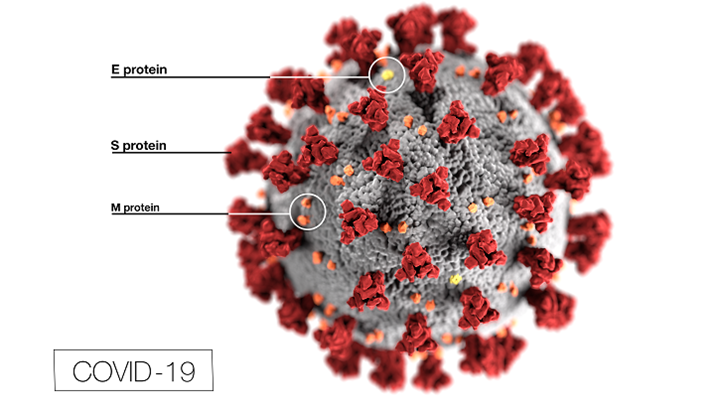

The root of this issue seeds back to the beginning of the pandemic when the economy was in a downturn. To combat the economic issues the pandemic created, the Fed attempted to stimulate the economy by lowering interest rates. In addition, the government sent out innumerable stimulus packages for citizens. Consequently, demand surged in the midst of a supply chain crisis, which lowered supply.

Many place the blame on the government’s exorbitant $1.9 trillion Covid-19 relief package with its $1,400 checks to most households which overstimulated the economy and caused it to overheat. Others suggest that the Fed kept interest rates close to zero for too long of a period of time, which also led to the overstimulated economy. Another contributing factor is the war in Ukraine that has engendered an enormous rise in oil prices worldwide. However, the reports of the Consumer Price Index, a leading determinator of inflation did not show gas prices as carrying the brunt of the hefty inflation Americans have been experiencing.

The government and various economists initially classified inflation as transitory, or temporary, as the economy was combating the side-effects of the pandemic, and trying to return to normalcy. Janet Yellen, United States Secretary of the Treasury, previously explained inflation as simply supply and demand issues, deeming it to be transitory. She voiced that the supply and demand issues arose when high demand by consumers was paired with the supply-chain issues. However, as time went on, inflation did not stay a temporary issue and progressed even further. The US economy was further pushed into a deeper inflation issue with other economic shocks that include China lockdowns, the war with Ukraine, and the emergence of other Covid-19 variants.

On May 31, Yellen admitted her failure in predicting the extent to which inflation would take its toll. She told CNN the following: “I think I was wrong then about the path that inflation would take… As I mentioned, there have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that I didn’t — at the time — didn’t fully understand, but we recognize that now”.

To fix this issue, the Fed needs to rapidly increase the interest rates to “catch up.” In doing this, it would be more expensive for consumers and businesses to borrow money, thus disincentivizing them to spend as much money, but rather save it. In turn, businesses and consumers are not as willing to spend money or invest, reducing the economic demand that has been extremely high. This plan strives to re-balance the distorted supply and demand scale that was thrown out of order as a result of the aftermath of the Covid-19 pandemic. In a press conference Fed chairman, Jerome Powell, explained this issue: “We are highly attentive to inflation risks. The Committee is determined to take the measures necessary to restore price stability. The American economy is very strong and well positioned to handle tighter monetary policy.”

Many fear that an economic recession is just around the corner. The reasoning for this is due to the fact that the Fed has announced its aggressive plans to raise interest rates in an attempt to curb inflation. However, a major repercussion of this is that consumer demand may plummet too much, and therefore can stifle economic growth.

Year-to-date, the S&P 500 is down 21.8%. Currently, the stock market is in a bear market as it has been down over 20% since its previous peak. Given the heightened inflation levels and the chaos that has been occurring in the economy, investors are fearful of the future and the decisions that the Fed will make regarding the economic situation.