Looking Back: How Have We Arrived at Our Current Economic Situation?

October 14, 2022

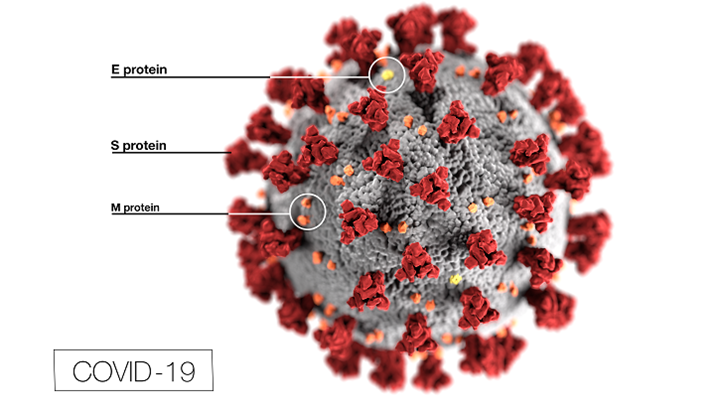

The cause for the condition of our current economy dates back to March of 2020 when the most significant shock completely threw off economies all over the world. This shock was the emergence of the COVID-19 pandemic that would intoxicate the globe and disrupt economies everywhere.

Since the onset of the pandemic, businesses were forced to limit their activity. Industries and sectors drastically fell and many had to shut down or even go out of business. A prime example of this was the travel industry, which suffered immensely as stay-at-home directives and social-distancing guidelines obstructed travel plans. As a result, numerous workers were laid off and production massively decelerated. Since many were left without paychecks, not as many goods were being produced, and with the uncertainty of the traumatic conditions, it was assumed that demand would decrease. However, this was not the case. Demand shifted as Personal Protective Equipment (PPE) became a foremost necessity for people. There was also an increase in online shopping for furniture and for other items people purchased for their quarantine.

As the pandemic grew rampant and working conditions altered immensely, further disorder took place. A primary exhibit of this was how shipping processes were in disarray. On the consumer side, the forecast of shortages caused people to stock up on certain goods fulfilling their self-created prophecy. In the United States, spending skyrocketed, along with the assistance of the government-issued COVID-19 relief package with its $1,400 checks distributed to most households. The availability of shipping containers and the congestion of transporting goods resulted in many issues for the supply chain. Between the combination of increased purchases by consumers, labor shortages, production slowdown, and a myriad of other reasons, a streamlining of countless shortages erupted throughout the globe with its effects leaving their mark still to this day. This became known as the Supply Chain Bottleneck.

The supply chain is how people receive their wants and needs. To produce a certain product, a company needs a network between it and its suppliers in order to get the appropriate resources to produce and distribute its goods. Take a car for example: for the car company to build the car, they have supply chains with companies providing the necessary materials for the car to be manufactured. There are then further supply chains that deliver that car to you. The inner workings of a supply chain are governed by the principles of international trade explaining why supply chains operate on a global scale. In doing so, supply chains ensure more efficient production and lower costs. Supply chains are a vital aspect in every step of the production and transportation of goods, and therefore, the effects of shortages within the supply chain allow this ripple effect to be seen worldwide.

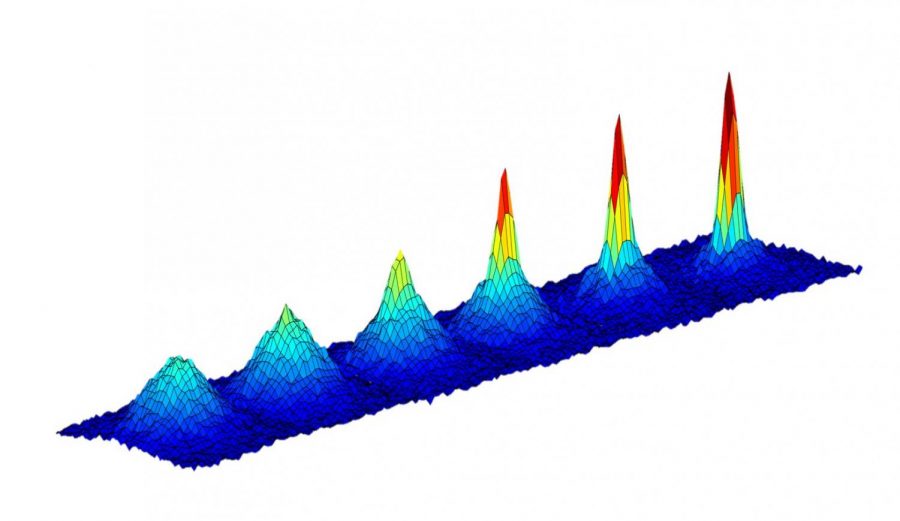

A shortage occurs when the quantity demanded is greater than the quantity supplied. When this happens, bottlenecks emerge where the supply chain system is majorly congested, slowing down the whole system. In the supply chain bottleneck of 2021-2022, the increasing aggregate demand as a result of COVID-19 and the aggregate demand determinant of consumer expectations caused the supply chain to become clogged up.

The supply chain was simultaneously clogged up due to the shortage of workers and restrictions that COVID-19 had imposed. Due to the bottleneck of the supply chain, production massively slowed and the short-run aggregate supply determinant of decreased productivity resulted in a leftward shift in the short-run aggregate supply curve. Consequently, price level, or inflation, increased substantially and the effects of this can still be seen today.

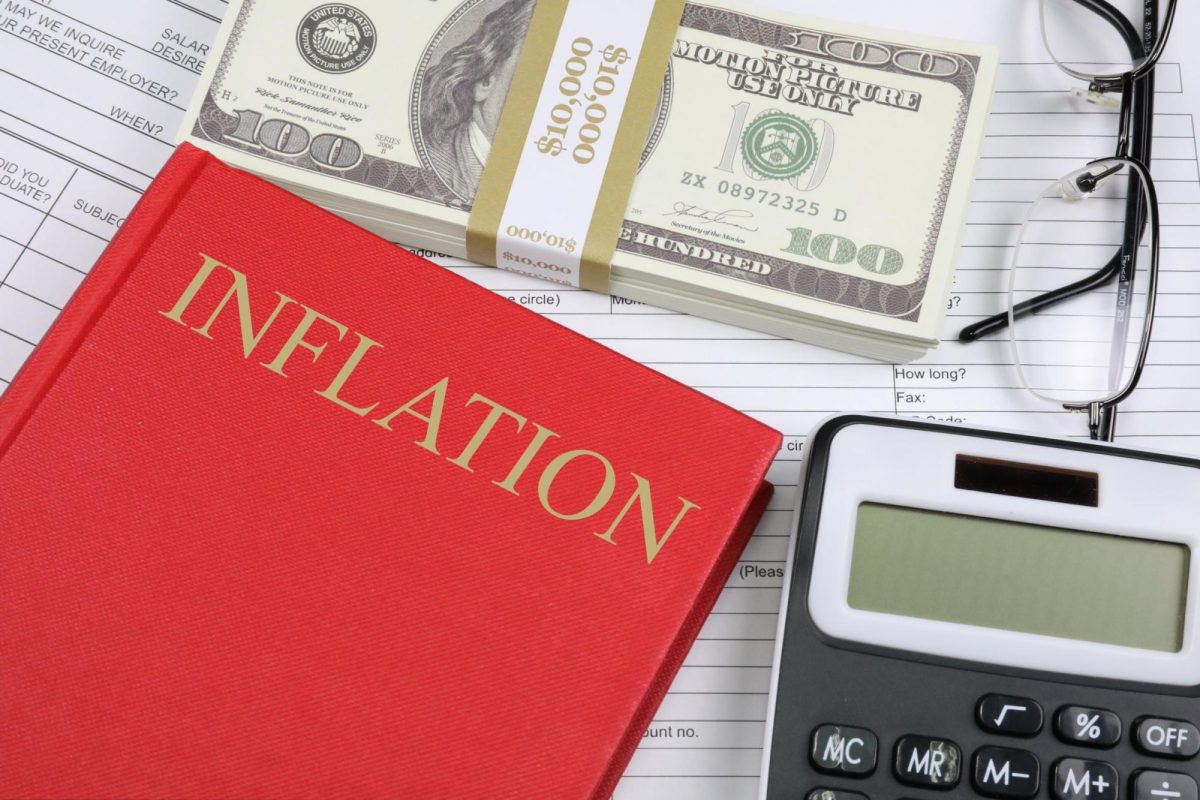

As a result of supply chain disruptions, consumers and businesses today face shortages for a wide range of goods and necessities ranging from baby formulas to raw materials. These shortages have also caused factories to halt production, consequently leading to negative GDP growth throughout 2022. Furthermore, higher shipping costs have led to a significant increase in prices for products that are imported or exported and have been affecting corporate profits. The lack of supplies has pushed factories to close temporarily and a gas shortage in some areas has prevented workers from going to work. Gas prices this year have tremendously affected consumers and have played a big role in the increase of the Consumer Price Index (an increase of 9.1% in June 2022). The inflation rate in July reached a peak as it was the largest annual increase since 1981 which was 8.6% at the time compared to its high of 9.1%. These increased costs at the pump, the grocery store, and even the car dealership have all been victims of supply chain disruptions and are negatively impacting consumers but also production. On the other hand, consumer spending which pre-pandemic was usually spread between the service side and the production side of the economy shifted solely to the production side as the service part of the economy was decimated and completely shut down, the end result meant that demand for products was higher and the manufacturing side was producing less which led to more demand and higher prices. Today inflation is at 8.20% which is still high, but a bit lower than when it was in July.

To try and fix the issues that emerged, the FED pumped $4 trillion into the US economy in response to COVID through stimulus checks, tax breaks, loans, etc. After a strong surge in demand and supply chain disruptions erupted, inflation started to rise. The FED at the beginning viewed inflation as transitory and was proven wrong months later. FED chair Jerome Powell said,, “As the reopening continues, shifts in demand can be large and rapid – and bottlenecks, hiring difficulties, and other constraints could continue to limit how quickly supply can adjust, raising the possibility that inflation could turn out to be higher and more persistent than we expect.”

The FED first increased interest rates by 0.25 percentage points in March following COVID after rates were close to zero during the pandemic. After, the FED increased interest rates again in May by 0.50 percentage points in an attempt to curb inflation. The FED continued to raise interest rates throughout the year as they raised it 0.75 percentage points in June, and 0.75 percentage points in July. The central bank most recently raised interest rates yet again on September 22nd by 0.75 percentage points. This totals to five raises in interest rates this year, totaling to the current interest rate of about 3% to 3.25%.

Overall, much has transpired in the economy since its inception of COVID which has tremendously impacted consumers and businesses due to the shortages it generated. But also, the price increase played a big role in today’s high inflation. Everything was a ripple effect that brought us to our current economic situation.