What Are Meme Stocks?

December 2, 2022

Most people have seen the term “meme stocks” in headlines in the news at some point. Meme Stocks have grown immensely in attention starting at the beginning of 2020, and investors have kept their eyes on them ever since. But what exactly are they? Are they considered good investments? Meme stocks are definitely something to look out for in the market as they can turn people into millionaires. But they can subsequently leave others with millions of dollars in debt.

Meme Stocks are stocks that receive mass attention on social media and gain mass followings that result in extravagant prices for their shares. These exorbitant prices are created when followers bring lots of hype towards their specific stock which influences others to purchase them. As a result, the stock goes viral, causing many people to purchase shares of the stock for no truly legitimate reason. Because individuals invest in the stock for the sole purpose of hypingup the stock instead of bringing actual value to their portfolios, the stocks become considered overvalued.

Now you may be thinking, Why would one ever invest in a meme stock? Well, most of the time, people (especially individuals who aren’t very knowledgeable in finance) become lured into investing in meme stocks because meme stocks are going viral all over the Internet. This compels individuals to invest in meme stocks because social media tricks them into thinking that it is a good idea. “Social media has made the accessibility and spread of (meme stocks) happen so much faster across geographic boundaries where people, who especially aren’t in finance and investing, get pulled in because of the story itself,” says Daniel Egan, director of behavioral finance at Betterment, an investing and saving app.

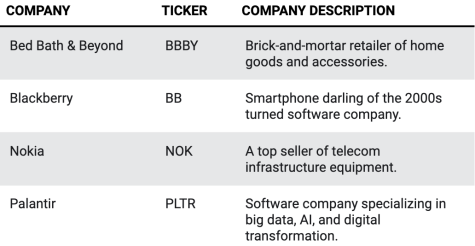

Meme stocks really boomed at the start of 2020 when companies like GameStop (GME), AMC Entertainment (AMC), and Blackberry (BB) gained a cult-like following. When most people think of meme stocks, they tend to immediately think of

GameStop (GME). In the case of GameStop, members of the Reddit forum called WallStreetBets’ strived to punish the hedge funds who heavily shorted (bet against) GameStop. It was meant to be a joke, but as the following picked up, this case became much more extreme. Eventually, the price of a GameStop share rose nearly 1,500 percent over the course of two weeks.

Even though numerous people became millionaires after investing in the meme stocks that soared. Investing in meme stocks is probably not the best idea. This is because when investing in a meme stock, one is betting against the market and is trying to outperform the market as a whole. However, when investing, it is extremely hard to time the market in a way that will make an investor money. As the growth behind meme stocks has no correlation to the company’s performance, they are bound to plummet just as fast as they skyrocketed. With that being said, to actually make money on a meme stock, one would have to time the market so immaculately, that the odds of doing so are completely out of favor and is almost impossible.

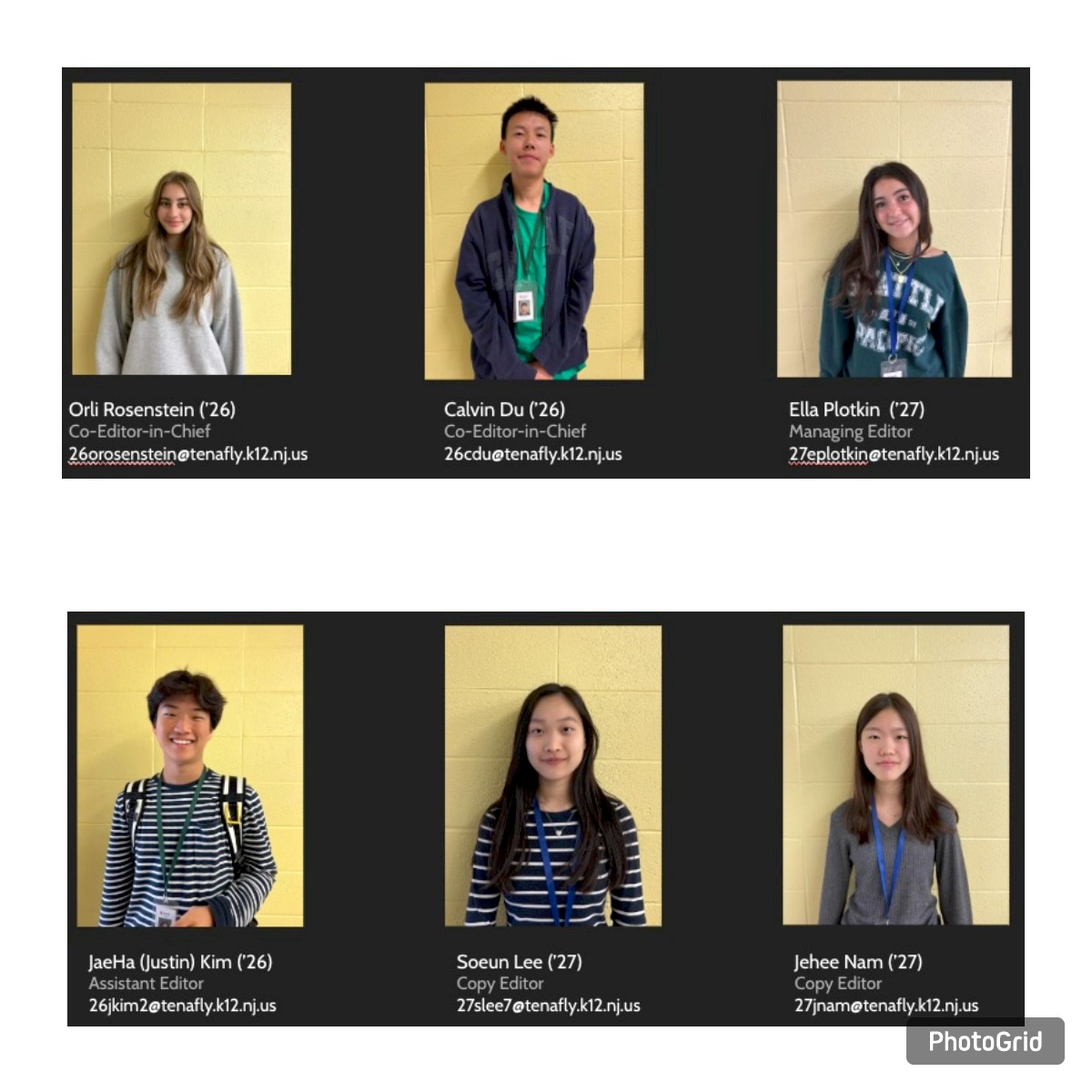

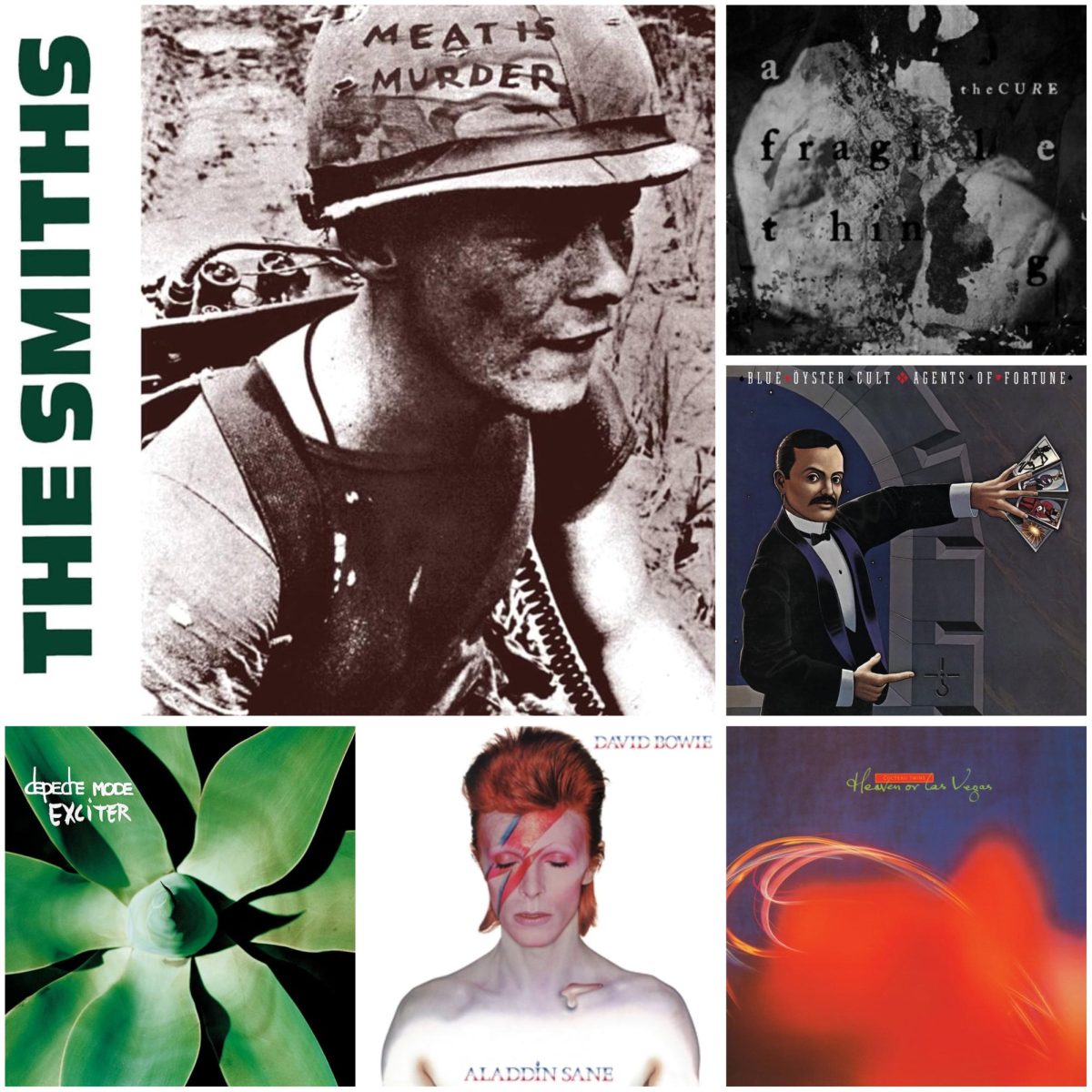

Below shows the top memes stocks according to The Motley Fool:

Meme stocks have undoubtedly aroused the market and are enticing investments—especially as they sweep all throughout social media. However, they are something that investors should keep an eye out for as they can be quite dangerous to mess around with. So, next time there is a hyped meme stock, maybe think twice before investing in them.