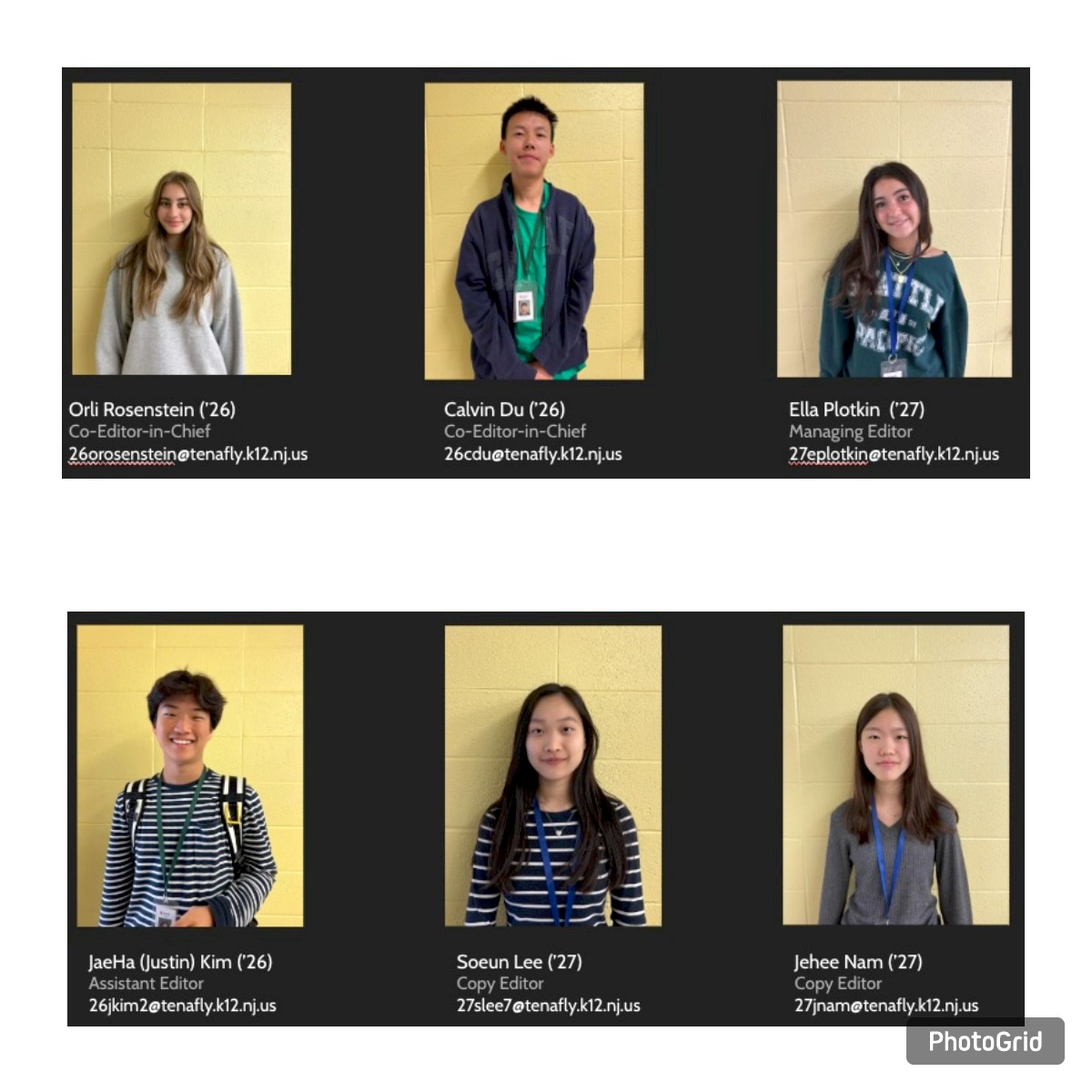

What Is Up With Stock Splits?

April 29, 2022

Recently, major companies including Amazon (AMZN), Apple (AAPL), Tesla (TSLA), and Alphabet (GOOGL) have been announcing their engagements in a stock split. But what does this even mean?

A stock split is when a company makes the price of its stock lower by dividing its number of outstanding shares. For example, if a certain company has 20 million shares available, each for $200 per share, it can split its 20 million shares in a way where each share is divided into two separate shares, each for $100. In this case, the company will now have 40 million shares each for $100. This example is a specific type of stock split called a “2-for-1” or 2:1 stock split, as each of the stockholder’s shares are split into two. After the stock split, the two shares are worth the same as the single share before the stock split. However, there are many other different types of stock splits that exist such as a “3-for-1” stock split, which is another very common stock split.

Stock splits decrease the price of stocks and increase the liquidity of a particular stock so that stocks are more available to the general public. The overall value of the company still stays the same (the market cap remains unchanged)––the value and number of shares are simply being rearranged. The dollar value of each stock is simply being decreased while the number of shares outstanding increases in an inversely-proportional relationship.

Companies use stock splits so that the stock becomes more available to more people. This is because stock splits lower the price per share of the stock, making it more affordable and appealing to investors while still maintaining the value of the company. For example, one may not be able to buy a certain stock at $600 per share but may be able to buy it for $300 per share. The price is then made more attractive. In other words, by lowering the price for each share, the quantity demanded of that stock increases.

Even though stock splits may sound good, many, including Warren Buffet, one of the most successful investors in the world, think otherwise. Warren Buffet’s Berkshire Hathaway Class A (BRK.A) is currently trading at over $500,000 per share as one of the highest stocks one can buy, reflecting Buffet’s dissent towards stock splits. Buffet believes that by not splitting a stock, only high-quality, serious investors will buy his stocks. Buffet explained this philosophy in 1995: “We want to attract shareholders who are as investment-oriented as we can possibly obtain, with as long-term horizons. I know that if we had something that it was a lot easier for anybody with $500 to buy, we would get an awful lot of people buying it who didn’t have the faintest idea what they were doing, but heard the name bandied around in some way…We are almost certain we would get a shareholder base that would not have the level of sophistication and the synchronization of objectives with us that we have now.” However, Buffet also has a Berkshire Hathaway Class B (BRK.B), which is a more affordable option for investors as its shares can be bought for only a fraction of the price. Regardless, Buffet still refuses to split his Class A stock, supporting his overarching belief against stock splits.

In addition, fractional shares have been growing immensely popular lately, reducing the need for a stock split. This is because fractional shares allow an investor to purchase shares at practically any price regardless of the number of shares. However, fractional shares are not available for all stocks. Nevertheless, if a stock brokerage firm has the option of purchasing fractional shares, one can buy a fraction of a share of that stock and offer more affordable options. Many experts believe that as fractional shares become more widespread, stock splits won’t be as important.

Currently, Amazon, (AMZN) Apple (AAPL), Tesla (TSLA), and Alphabet (GOOGL) have announced stock splits for their companies. Both Apple and Tesla split their stocks on the same day of August 2020 for a 4-for-1 and 5-for-1 respectively. More recently, on March 9th, Amazon revealed that they will have a 20-1 stock split, with a $10 billion stock buyback. This means that for every one share of Amazon, 20 different shares will be divided from it. This will decrease the share price of Amazon from $2,785.58 per share to $139.28 per share. This will be Amazon’s fourth stock split since going public, and Amazon hopes to make its stock more affordable to investors.

Alphabet also recently announced their stock split on February 1st for a 20-1 stock split. The stock split will be put into action on July 15th when holders of Alphabet stock will receive 19 additional shares for each one that they own, and the price per share will be divided by 20. This stock split will decrease the share price of Alphabet from $2,758 per share to $138 per share. Alphabet hopes that by decreasing its price, it will be more viable for retail investors who may not be as willing to spend as much money.

Overall, stock splits are a very common strategy for companies that various firms have been carrying out. However, many believe that stock splits are not helpful, and some even think that they do more harm than good. We will just have to wait and see how these newer stock splits play out.